Appraisers Need to Learn to Stop Being Doormats!

Being a bad businessman is not an excuse not to pay me. Period.

The borrower pays the AMC up front. The AMC HAS MY FEE FROM DAY ONE! If they do not have it on the date I complete the assignment, it is because they used MY MONEY for some other purpose. If they are too incompetent to operate a general ledger, then open a second checking account and make the fee deposits for the appraisers the same day they are received.

Being a bad businessman is not an excuse for not paying me for work I do for you. Period. In all my relationships with past partners, employers, clients and other appraisers I have had ONE OVER RIDING rule:

“Do NOT ‘mess’ with the money!”

I actually use a slightly different word that conveys a much more forceful meaning. I make NO EXCEPTIONS to this rule for anybody. Though I have knowingly worked for free.

I use MY money to pay my mortgage, and to buy gas for my car so I can go on assignments. I use it to feed my family and pay my utilities. If some ‘executive’ at an AMC thinks I am going to subordinate the needs of my family to their bad business practices, they are sadly mistaken. The LEAST they could expect would be for me to plaster their name allover the internet, file complaints with CFPB, FFIEC and anyone else I could think of, plus their state authorities. Not just the name of the company, but also the people I spoke with there.

Having said that, here is some words of caution:

- IF you work for an AMC, the VERY FIRST time they do not pay as advertised, cut them off until they do pay. Let the circumstances of that payment dictate whether you do future work for them.

- NEVER build up more of a ‘bank’ or accounts receivable with one lender or AMC than you can afford to walk away from. New AMC clients should probably be from one to no more than three assignments AND LET THEM KNOW!

“Once we are used to working with each other and satisfied with each other’s performance, I’d be willing to accept more assignments but until we have some mutual history the most I can have outstanding is three assignments.”

IF they are legit they will accept that with no hard feelings.

- For established clients its tougher. You don’t want to lose work, but neither do you want to leave yourself over exposed. I would not let more than $2,500 remain unpaid a any one time. Even then, I’d be REAL sensitive to changes in payment practices. Especially when they say they have switched to a new accounting system or AP firm and that causes a late payment. When their payment pattern changes, takes longer, do not be afraid to cut them off!

- Consider using one of the “no charge back” Factor Services. Some advertise that they only charge 5% and never charge the appraiser back if the client does not pay. Read the fine print! Personally I’d give up 5% to get paid in less than 30 days.

Right now I am being told that a company called “Valuation Partners” is paying appraisers in New York very late, over 60 to 120+/- days. I only have anecdotal evidence form three appraisers, and obviously have only heard one side of the story. But it looks like something we, Appraisers Guild of Appraisers (AGA), may become involved with.

If any other appraisers have experience, good OR bad, with this firm, please let us all know. If these are isolated instances or legitimate service disputes we don’t want to be unfair to the AMC. If they are NOT disputed debts, then we want our fellow appraisers paid…NOW!

Appraisers need to learn to stop being doormats. Theft of service is still theft!

If YOU are having the kind of payment trouble outlined in any of the above, you really need to join with us at AGA. While we can’t promise payment results, our experience has been that a letter or phone call is usually enough to generate payment. We are NOT a collection agent, but most AMCs we’ve contacted have preferred to pay their appraisers than to take on a Guild within the nations oldest union over something they know they are obligated to pay anyway. For those that may have forgotten how to join AGA, call Jan Bellas at (301) 220-4100 or email to JanBellas@appraisersguild.org

- The New & Improved Fannie Mae “FRAUDULATOR 2.0” - May 15, 2023

- The Scam of Racial Discrimination by Appraisers - May 10, 2023

- What Is My Incentive? - September 20, 2022

so what’s wrong with having someone wipe their feet on you. seems like most of us have gotten used to it. when was hvcc thought of. keep up the fight mike, maybe more door mats will drop out, or just wear out, we are getting to be an old group, aren’t we. i suppose the fight for independence didn’t just happen on july 4th, 1776. took some nasty fighting to finally win. soon, maybe soon. maybe the mat is getting a little thin now.

Like the picture. Semper Fi.

Semper Fi Paul!

“semper fi do or die hold ’em high at 8th and I” and I’ve forgotten the rest. Then again it HAS been awhile. 🙂

Haha. Yes it has for me as well. I actually live in DC getting my Masters in Real Estate and I haven’t even been to see 8th and I, yet. I’m such a bad former Marine… 🙂

I used to road race along Rock Creek Parkway under the Kennedy Center overhang in a ’74 Lotus Europa (SII) not the twin cam, past Embassy Row to a place in NW (?) near Chevy Chase(?) or was it Bethesda- called Henry’s I think. Even went through downtown once at no less than 75 including corners (Bless those wide DC streets at 4AM!). Ah to be young and dumb again! How do males survive their 20’s anyway?

At least I have half of it still *g*.

I find it amazing that AMCs are not required to place these funds into escrow accounts just as brokers are required to deposit good faith money into within a specified number of days. Anyone who dares to use escrow funds for anything other than a refund or a contribution towards the closing is in SERIOUS trouble.

Might I go so far as to suggest that the current system was created with financial abuse (and not the prevention of) in mind? It doesn’t take a genius or even a legal mind to figure out that these funds should have gone into escrow accounts from day one.

Does this come as a surprise to anyone since they are ALSO allowed to:

1. Legally extort appraisers month after month (pay to play).

2. Lie to borrowers on the HUD-1 in the face of Truth In Lending laws.

Lucky Luciano & Meyer Lansky could not have devised a more foolproof system for extracting billions from the pockets of appraisers year after year.

Spot on! I have been surprised all along that escrow accounts are not required for this money. And so disappointed the HUD-1 was not upgraded to be consistent with Truth in Lending.

If the funds were held in escrow, a whole range of rules would suddenly be applicable, and the fee skimming would instantly turn from a business model, into outright theft. It’s the little details which were overlooked, which created this organized chaos. / Mike, you’re going to love this one. LOL!

We have a new product which is a review of a BPO. You’ll need to log onto a site and complete a checklist. The pay is $25 per report with a 24-48 hour turn time. Most can be done in about 10-20 minutes. All work can be done from your desktop. Training will be provided.

Please let us know if you are interested. At this time, we are reaching out to garner interest. We’ll let you know the next steps as we do.

**these orders would be sent via Mercury Network

Sincerely,

Service 1st

The fun will likely begin AFTER this election cycle. Interest rates have been kept artificially low for far too long. At some point world wide investors are going to demand more than 1 or 2% ROI. Certainly more than “negative interest” as some of the Fed-Fools have postulated.

Anyway, I digress. Why would anyone even bother to review a BPO? Last time I saw one being “performed” it was by the Realty agents handyman. Time before that it was the agents 17 year old son that was telling me he had performed it. He was so proud of himself!

Don’t you just love a family that passes along the trade secrets to the next generation? Like how to commit fraud?

Now FNMA is bringng us all around full circle. Appraisers used to be part of NAR before they broke away circa 1933 (’35?) due to perceived conflicts of interest. Now that we have all matured, FNMA can return valuation to agents without all those pesky standards to deal with, or people that might QUESTION Fannies degree of incompetency.

All I can say is NO MORE FEDERAL BAIL OUTS! Let those who are demanding faster turn times and less regulatory oversight bail themselves out on the next one!

1933 mike? i don’t even remember that year. very interesting fact that i never knew. history is important to know & and understand. the only bail out for bankers & wall st should be from a bail bond’s man, preferable returned when sentenced to long prison terms.

I suspect the work request to review bpo’s is another innovative attempt at skirting state to state rule variances. The lender runs bpo standard nationally, and then legitimizes that when they have to, with an appraisal attachment in states which disallow the bpo for official value documentation.

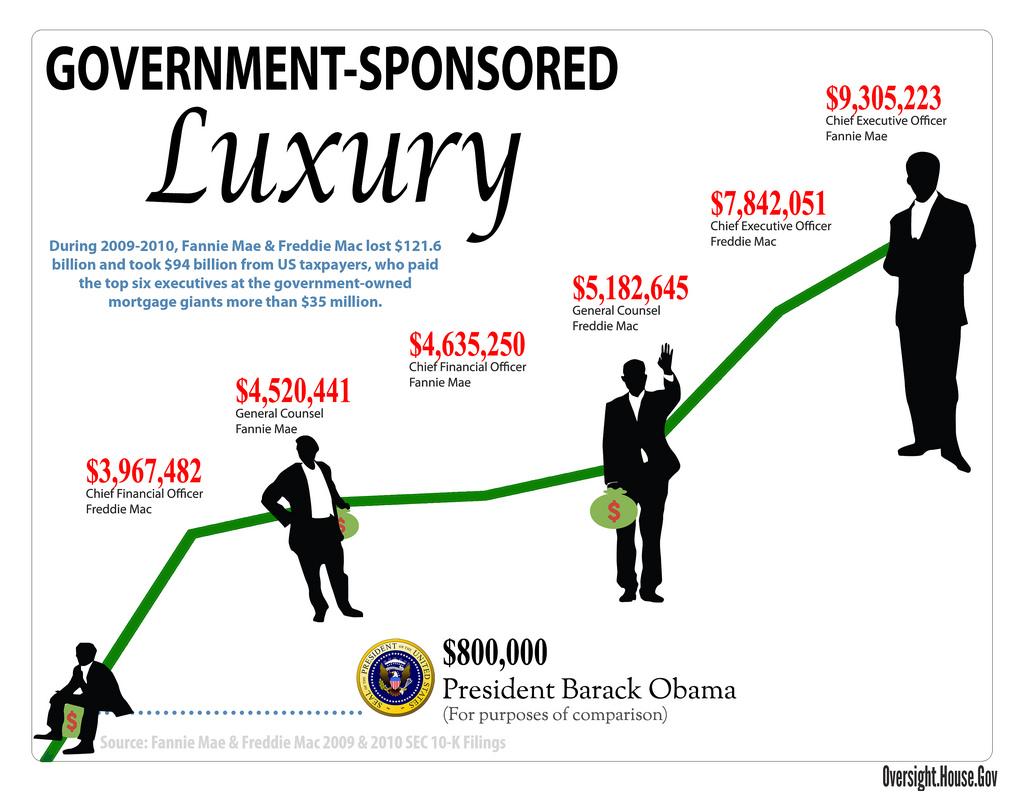

If you’re going to get tough about FNMA, you can’t forget this picture.

Appraisers should remember how small they are in the bigger picture, and how much money the lenders make in the course of having to utilize appraisal services. The use of an appraisal is a requirement, not an option. Appraisers who don’t understand that, end up relegated to discounting and competing with each other, rather than being well positioned to demand more from the distributors. Like how far down do you need to be as an appraiser, to review bpo work? Any appraiser worth his salt who wanted to get into bpo work could double down the pay, and land listings, by getting the sales license themselves. Reviewing bpo work is beneath a licensed appraisers appropriate station. Of course, the nutty and imaginative amc clerks seeking a new product to sell, simply don’t understand the professional relationships and requirements, right in front of them.

Tom D. *G* Nor I! Though I have read about it.

Censored Baggins – Outstanding perspective (chart) President of the Most powerful nation on earth is considered to only be worth $800,00 a year, yet executives at an incompetently run quasi GSE earn HOW much?

The first thing Mr. Park and others at ASC.gov need to do is start giving some extreme financial haircuts. There is NO REASON anyone at FNMA should earn more than Executive Comp levels of Management Level appointees in civil service…about $105,000 to $150,00 without the bonuses.

When they stop taking taxpayer money, they can start collecting Wall Street salaries again PROVIDED their is a stipulation that the federal government will NEVER again bail them out!

On a side note Mike, Mortgage News Daily (MND) has a new article “Appraisal News and Trends; Comp Survey on LO Base Pay” that does in a limited way bring to light recent appraisal pay issues. However, providing our opinions (from an appraisers point of view) in their comment section and their Q & A section is flawed as they have edited my comments, deleted my comments and have banned me from providing my opinion. What I see and can do is very limited.

Of course at the bottom of the article under the heading Jobs and Announcements Sterns Lending LLC is wanting new sales staff. This same company a few weeks back indicated in MND that they now have flat appraisal fee structure to in part improve accuracy. They also said this approach will provide a much greater certainty of the appraisal fee to be charged to the consumer, so fees can be disclosed accurately up front.

I tried to maneuver around that site Bill. Don’t know how you can follow anything there. I suspect that even their own members don’t really read it much. This post would be considered ‘lengthy’ there.

Yep, they censored me a while ago, when that MND was buzzing on the AF regularly. Never went to their website ever again. LiveValMag did that to me as well, and many other appraiser posters whom responded negatively to their pro amc pieces written by now defunct amc persons. Truth about lenders pay is they should have all been placed on salary by now. It’s not rocket science, and the most trustworthy ML’s are the ones at the CU, on limited commission or outright salary. The non commission lenders usually have a more symbiotic focused approach to dealing with appraisers. Probably not a coincidence that MND caters to commission based ML’s, and they subsequently find it acceptable to censor or remove the open reader posts by appraisers.

I’ve always said that AMCs are nothing but a pyramid scheme. They’re getting paid BEFORE they ever send the report to their client. That means they are paying yesterday’s bills with today’s money. How long before that will come crashing down?? If their costs to run their offices and business needs starts to exceed their income from clients, the appraisers seem to be the ones who suffer. We’ve all seen examples of this.

The AMC business model has been and will always be a joke.

Its a shame the appraisers out there were ball less and just gave into the lenders demands regardless of their own professional licenses. Which they shouldn’t have had in the 1st place if it wasn’t for mommy or daddy. Any appraiser who lets a client owe them even more the $1,200 is an idiot and deserves what they get.

The AMC business model will go down eventually without these appraisers, so its only a matter of time before those working for them get screwed out of their hard earned money. A lot of work is out there for real fee’s.

On the contrary, the sweat shops and company men are the ones whom undercut this business to shambles. I suppose it can go both ways, so blanket stereotypes are not helpful. I’ve never seen a family firm offer the trainees 25% as 1099’s and demand 48 hour flips and 2 a day quotas. Those are the sweat shops which churned out 2k base experience hours for all whom dared apply. Family firms are more likely to offer base salary, and only go commission or allow independent work duties when the apprentice is ready. / Your premise on outstanding billing is flawed. I can easily go $1,200+ on two complex orders, or just three standard ones. I prefer a proportional distribution of billing risk, and paper based billing tracking so I never miss anything. Nobody gets more than half of my attention, and randoms get no more than a fifth of my schedule availability at any given time. Over 30 day payers are limited even more so, and upcharged as a constant. The solution to billing uncertainty, is to quote longer in time, and that is less likely to get away from you. Standard 2 weeks seems to work well, and companies will usually limit your assignments anyways if those are your terms. It’s the guys who flip reports daily at discounts, whom ultimately take the biggest losses when the accounts payable account goes negative. Soon to be defaulting distributors love to channel all the work to one person or firm. That way they only have one person or firm to contend with when they default. It’s the appraisers whom discount for preferred assignment positions whom put themselves at the most risk. I don’t feel bad for them when the clients default, and could not relate to the heartache stories about defunct amc payers. It was those same appraisers whom did not get paid, whom undercut the rest of their peers and got preferential assignment positions for all the wrong reasons. They got exactly what they asked for, promoting unscrupulous middle management practices. They fueled the fire which eventually engulfed them. If they did not see that coming, they were blind.

CB, I think your view is more accurate than Chris’ from my own experience. It took me eleven years to get into the profession. I wasn’t born into it. Though in fairness to Chris, we’ve all seen appraisers who make us wonder how THEY ever got in.

There is no magic fee exposure number. Like you said, more complex SFR jobs can be $750 to $4,000 by themselves. Then again, I NEVER invoice those! I COLLECT at the door. As far as AMCs go, I cant see letting them have more than three (3) SFRs jobs outstanding at any one time. A hit of $1,350 WOULD usually hurt me unless I just happened to have gotten paid on a commercial job too around the same time; but it wouldn’t put me out of business.

My old partner took a $2,500 hit and it almost put him under. HIS kid was in pre med; wife was selling real estate…or at least she had a license and tried to sell R.E. I don’t know about you guys, but any savings I had disappeared by the end of 2010 when I was having to rebuild my fee shop from the ground up.

As for some brokers that took up to $$5,000 hits for doing BPOs when their AMCs went under, I agree no sympathy. They thought those $90 to $125 BPO fees were easy money compared to listing and selling. They NEVER BOTHERED to be concerned whether they were legal products or not!

I was shocked to see Mr. Baggins declare that appraisals are required by the fed. In 2015, 323.3 was modified to allow the use of any valuation method acceptable to Fannie and Freddie, functionally taking the country back to the Wild West. See my article in this month’s Appraisal Today (pg. 9) about the GSE AI AVM that will put resi appraisers out of business by 2023. The GSEs are neutering the appraisal “requirement” by preparing the AVM behind the scenes and rolling out tons of new loan programs that do not require appraisals. Everybody on this page (including me) should go get their FAA drone pilot’s license! It’s a simple formula; the minute lenders can be assured of a collateral-related loss ratio under 5% of origination value or origination expenses, the carbon-based real property appraiser is toast. (Me: 45 years in finance; chief appraiser for Commerce Security Bank; The Money Store; Ameriquest Mortgage; Wells Fargo REIG; Morgan Stanley Mortgage Capital and several others; property valuation manager for Countrywide Securities, Hansen Quality Loan Services; founder, 2006, InsideValuation LLC (commercial BPOs, sold to LRES a few months ago); until July of last year, Senior Property Appraiser / Investigator, Bureau of Real Estate Appraisers (California).

Hey, what do you call an appraiser at your front door with no arms, and no legs? Matt!

What do you call an appraiser with no arms and no legs whom bounces to higher paying clients? Skip!

With no arms and no legs, reviewing amc stipulations? Russel!

With no arms and no legs, raging over unnecessary revisions and discount fee requests? A normal well rounded appraiser. If only they had arms and legs to stand up for themselves, and reach over to a better client source.

Or to simply stand up for themselves and oppose those things that are wrong in our own profession and the related lending industry.

Come on people! http://www.appraisersguild.org Janbellas@appraisersguild.org (301) 220-4100

As grateful as we are for general members, we also need a few more “spark plugs.” People that not only see the problems, but that are also willing to do something about them. OPEIU and AFl-CIO can help in the regulatory arena tremendously, but so much of what we do is ‘down in the trenches’ it requires OTHER appraisers that understand USPAP and appraisal principles and who are willing to TELL state officials when they are wrong! Some state coalitions do this well (LA, VA, NC), but many do not, for a variety of reasons. Equally important we need coordinated national pressure to get anything meaningful done.

Some examples:

California: (yeah, I know) but I’m kinda busy with national issues; we need someone to push CA into adopting C&R ENFORCEMENT rules rather than referring us all back to CFPB who in turn doesn’t even have a link on THEIR site for appraisal (fee) complaints. Or, at least help me to do so. We stopped AB 624 but there is MORE skullduggery in the offing we are already hearing rumors about.

Oregon: Teach THEIR Board USPAP! (Seriously). They were trying to fine people for not meeting turn times, as a USPAP violation! TWENTY FOUR PER CENT of the AARO (Government Regulatory Officials) members they contacted for advice ALSO thought the same way! AARO itself needs some attention now! When THEY give states advice it looks like there is a 1 in 4 chance it will be WRONG!

New York: They drafted a pretty decent AMC law and they NEVER PASSED IT! What’s up with that? Also need to fight to make sure they don’t dump the appraisers must be paid within 16 days provision!

New Jersey, Minnesota, Illinois: and how many others – Ongoing reports (and evidence) of punitive mindsets rather than protective of the public views. They are using fines to balance budgets rather than as educational and or enforcement tools! Minnesota enforcement officials also need appraisal principles refresher classes when they start using phrases like “everyone knows you always adjust…” for things like wooded areas in proximity — regardless of market data to the contrary apparently.

Massachusetts, Florida, DC, Maryland & California: as well as any other states that “pile on” charges AND fines for appraisers fined in their home states for home state work! I can see other states being aware of and perhaps restricting licenses of those fined for work they did in their home states, but to also fine them in the secondary license states that were not at all involved is abuse of power! Sincerest apologies to V.T. in Virginia for not having the time to help you on this one! One of the worst abuses I’ve seen yet!

Give me just 25 people across the United States that are such ‘spark plugs’ and we can eliminate MOST of our problems in just one or two short years! Look how much (a very few) State Coalitions, and AGA have accomplished already in the past one to two years! We won’t rewrite all laws in that time, but we can sure as hell make a dent!

This is not hyperbole or braggadocio. It’s offered as proof a few people CAN make a change! I (with others I recruited) have DONE this in the past. 1986-1990 Redondo Beach, CA – we created the groups that replaced 4 out of 5 crooked council members; even before that we ‘maneuvered’ them into positions where they had to create new board member positions for CITIZENS interests and ultimately made them rewrite their entire Community General Plan! (Oh yeah, we hastened the retirement of the Harbor Director, City Manager and embarrassed the hell of out the U.S. Army Corps of Engineers so badly THEY had to return to Tennessee and redo their hydrographic studies completely. Redondo Boat Owners Association, Harbor Users Rights Committee, National Water Users Rights Committee, Citizens General Plan Advisory Committee (GPAC) opposing local power players; Harbor Pier & Lessees Association; CRA, Southern California Edison, State Attorney General, State Coastal Commission etc., etc. etc. Not to mention the peripheral issues we were dragged into because we were EFFECTIVE!

My friends & peers, I LIKE writing, but I’m not here for that purpose. I’m trying to DO something. AGA with its bigger, more powerful ‘uncles’ gave us the vehicles, but we need more drivers!

Best thing in my opinion to come out of CO rules, was that I no longer am presented or have to sign indemnity agreements. That’s a critical consideration, for my mass marketing substitutability program.

You’re doing great Mike, keep up the good work. Myself, I avoid government at nearly all costs. It’s rather ironic that I’m a real estate appraiser. Go figure. The power of the pen, and all of that. We keep on going. Liked to read your posts at workingre as well.

I cannot surf the AF anymore, because they don’t like sensible surfers whom have adblock and flashblock installed. You’ll find me blogging in the space with no or limited advertisements. If I have to actually log in, I’d better not see an ad right away.

Mike, those are great concepts. I just spent a half hour reading up on the latest with FNMA, and apparently a major hedge fund guy now owns over 10%. (For appraisers, that is a rather hilarious notation, given the existing rule sets within FNMA itself for such ‘over 10% ownership’ sort of activity on real property.) Word on the beat is they’re profitable again, but all funds are redirected to the Treasury, and investors are arguing for release or something along those lines. Here are a few interesting articles about FNMA, which I found insightful, but negative in scope.

FNMA buying hedge funds: http://stopforeclosurefraud.com/2015/06/17/do-hedge-funds-make-good-neighbors-how-fannie-mae-freddie-mac-hud-are-selling-off-our-neighborhoods-to-wall-street/ & Hedge funds sweeping up purchases.

(fyi; additional news sources point to international investors and such. I keep saying the foreign investors are going to lose their shirts on det sf housing rentals as investments, because Americans who rent, probably do so because they don’t have their act together enough to buy. This article challenges that notion, but to what extent that’s actually factually challenged, remains uncertain. I maintain the position that regular Joe’s can beat out investment purchasers, with the right steadfast gameplan, attention to thrift and debt free life styles in their personal financial dealings, and a credit union to back them.)

http://www.miamiforeclosurelawyerblog.com/2015/06/report-hedge-funds-buying-dist.html

Here is another broken record slogan; They made so much money on the last pop, they can’t wait to blow up the markets and pop them again. Now that statement may make more sense, given the investors are apparently getting stiffed on investment returns. Just like my comments about not feeling bad for discount amc appraisers who got shorted earnings, I don’t feel for the investors of FNMA either. If they would have controlled that company better, it would have never defaulted. When it comes down to it, normal every day rules should apply to the onlookers of this train wreck; Publicly traded companies prioritize profits before people, so don’t expect anything but that, when anticipating their business decisions. Nobody escapes mortgage servicing, until they no longer have a mortgage to service. Food for thought. Own it or bust. There is no greater objection than absence. I’m working hard to pay principal down faster, because this system is not a safe place to hang out.

Baggins: as we’ve seen over and over again, if the rules become too burdensome, FNMA will just pressure Congress to tell the regulators to make the more ‘flexible’…again.

I agree re Credit Unions. Especially now that there are so many local ones with expanded fields of membership. My biggest financial regret is becoming inactive in my old NFCU account. Best CU in the world, but at least I have a semi local available where car loan is. CUs are no friends of appraisers in general though. They really bought into that AVM BS. One of my old bosses order appraisals now and says its all BS. Never could persuade him otherwise. Head of mortgage lending is an old friend and she’s more receptive to realities but in the end, price pressure on ‘behalf of the members’ wins out.

As for FNMAs foreign investors (and any other real estate securities investors); they buy recklessly because they know that (1) the loans are mostly insured; (2) those that aren’t can be pushed back at FNMA in event of defaults, (3) if the insurers and re-insurers like AIG or Societe Generale in France are in danger of going bust again, Uncle Sugar will come bail them out (Again). Someone tell me again how THAT is free enterprise?

Investors in SFR (REITS) CAN do ok IF they were bought at depressed prices where leveraged debt service and operating costs are well below area rents. My old broker from 45 years ago had over 200 sfrs and 2-4s until his divorce. Even after the separation both he and ex wife live pretty well off. Best guess $70 to $75 million portfolio.

You got that right. Need more HUD appraisers? Just drop the requirements..we don’t even care if they’re alive. Have any appraisers locked up Federal prisons? We’ll take them. The industry is an absolute joke.

Thanks for your input Mike!

It is not just the parasite AMCs that give appraisers a ration. Today I went to the post office and there was an electric bill. Not any of the checks from Banks or Credit Unions that are past due! I am referring to several thousand dollars of past due fees (enough to vacation in Australia this summer!) I learned a long time ago not to accept any assignment from an Appraisal Management Company.

Yes, I know that these clients will pay me….when they get damn good and ready. In the mean time they will have their processor call and check the status of an assignment over and over several times each day. There is no shortage of appraisers just a shortage of those who do not give a damn! Best regards to all!

Hello, I work for an AMC and it’s like some appraisers don’t consider the other side of things, they don’t consider the client or the people they’re helping. I consistently have appraisers requesting MORE money than the client is even paying for the appraisal, and quote me with outrageous turn-times which I have to then convey to said client. You are not the person who gets chewed out because the appraisal drags on and causes the borrower to miss their closing date, that would be the AMC. We’re the ones who deal with angry brokers so you don’t have to, we’re the ones who soak up that stress, not you. We make sure to provide the appraisers who are able to meet our clients’ due dates and expectations with plenty of work and we make every effort to work with them on their fees as best as we are able while still keeping our doors open. But what really boils my blood is when an appraiser demands $500+ for a conventional appraisal and is then days past due with nothing but excuses. We have to deal with these brokers who are constantly down our throats with requests for updates on the appraisal, which getting from most appraisers is like pulling teeth. This is a business, and in business everyone does their part and everyone gets a piece of the pie. If you want more money, then accept the work we offer. We enjoy working with appraisers who don’t decline every other order we contact them about. We don’t enjoy working with appraisers who try to bleed us dry on only the best orders and decline anything that looks a little ugly. We have families we need to feed too, you aren’t the only ones who have a part in this industry.

@The Other Side:

What evidence do you have to support your view that appraisers do not consider ‘the other side’ meaning client or the people they are helping? Clearly you know little to nothing about what or how an appraiser is supposed to approach appraisal assignments. There ARE rules that govern what we can, cannot or MUST do on every single assignment. Those rules equate to time and skill.

As for ‘more money than the client is ‘even paying’, you mean more than the gross fees of $495 to $550 that mortgage lenders and banks have uniformly negotiated with AMCs like yours, with no regard to the scope of work required under USPAP (different than YOUR perceptions of Scope of Work, I am certain). Well lets address THAT: AMCs want a one size fits all national fee, regardless of complexity; and you want certified appraisers only.

OK, THAT fee would HAVE to be based on at least $85.00 an hour (within FNMA conforming loan limits). Now I personally believe the average non complex time requirement is 8 to 12 working hours; but some attorneys hold that the norm should be closer to 6 based on testimony they’ve heard over the years. I don’t happen to believe it, but just for arguments sake, lets assume that’s true.

Six hours at $85.00 per hour is $510.00. Unless YOUR AMC is billing YOUR clients at the high end of $550, AND only keeping $40 per order, then you cannot AFFORD good quality reports from certified appraisers.

As for turn around time, YOU do not get to dictate that. Each assignment has variables. I MAY have to wait for return calls from listing of selling agents at the comparables; who in turn may not call back for two or three days if at all. I may need to wait on call backs from planning or zoning departments or home owners associations. Example, how long do YOU have to wait or how many calls do YOU have to make to get call backs from appraisers?

The LAW dictates the steps that we MUST follow in order to properly complete appraisals; NOT the client. Certainly there would be less conflict if YOUR bosses hired competent, qualified appraisers to determine who to assign real estate appraisals to, but then THAT would require standing up to YOUR clients unreasonable demands. Because you and your bosses either choose NOT to do so, or simply do not know WHEN to do so, it means that WE still have to dig in and hold firm to YOUR asinine and uninformed ‘requests’.

As for “requests” for revisions; they are often prohibited requests like removing negative comments about a property condition or its location (we cannot do that); OR (my favorite) a demand that the FNMA standards ordered, completed and delivered appraisal done two weeks ago just be ‘retyped’ for use as an FHA appraisal now. HINT: CANNOT legally be done!

You say that “this is a business” and everyone does their work and gets a piece of the pie. Well, not exactly. You see WE are a profession. YOU are an opportunistic parasitic alternative to a SOUND BUSINESS MODEL followed by banking for many decades and only abandoned in 2009 under HVCC.

You provide NO SERVICE to us. None. You COULD do so IF you (as an industry) had any integrity, but you do not. You see an appraisal as a commodity rather than a professionals product. You take the (unethical) loan brokers part that anything is ok to make the deal happen, and wonder why we resist.

As for you being unhappy dealing with appraisers if you had ever bothered to learn OUR needs as a profession or to meet those, we’d be less difficult. You DO have an alternative though.

Practice speaking very clearly “Would you like a side of fries with that order?”

OR you can study REASONABLE fees at http://mfford.com/html/c___r_fees.htm

Mr. The other side,

Sir, you say you work for an AMC and as such you bring NO punch to the party! As a full time appraiser I have zero use for you or your AMC company! If you want to appraise property, please do so. There is no need for you to take an assignment and then attempt to get me or another appraiser to do the work only to have you skim part of the fee. Why do you not go and get a real job?

I have to wonder what is wrong with an appraiser who works with AMCs? Try to do a bit of marketing! Some of us NEVER work for an AMC and turn down several appraisal assignments each week just because we cannot get to them. No need for an AMC! Oh well, what do we know? LOL

Dear Mr. The Other Side,

I would like to say that my heart bleeds for you and your AMC but in reality I hope everyone connected with an AMC dies the most horrible death imaginable.

Did appraisers ask you to take on the burden of dealing with angry brokers? No I had no problem dealing with angry clients or brokers before AMCs were SHOVED DOWN OUR THROATS.

Did appraisers ask you to deal with headaches of long turn times? No (In fact we provided most clients with 24 turn time before HVCC came along). Give appraisers back the $300 that you’re stealing from their pockets each day and I’m sure that most will gladly relieve you of that burden.

Did we ask you to lie on the HUD-1 about the actual appraisal fee? No

Did we beg you to allow us to extend loans to you for 30 to 90 days (interest free). Not hardly.

Did we ask permission to “bleed you dry”? NO and I think you are referring to the incorrect party that’s being bled dry.

How do you sleep at night knowing that you are nothing more than a low life blood sucking leech?

I have four short words for you but I’ll let you figure out what I have to say to you. GTFH

quit. as a matter of fact. no appraiser will miss you. i have no sympathy for you or your family. your employer could care less about appraiser families, and probable you too.

best of luck in your next job where the people involved may think you have given them some value.

Wow. What a pessimistic petty little thing you are. You are just bitter because in a world with AMCs you aren’t able to slack off and still make all the money. You’re held accountable for your actions, and how terrible you are at your job is actually brought to light and shoved in your face. It’s appraisers like you that end up on our inactive list with a little note that says “do not use, has a bad attitude”, and a reference list of all the orders you screwed up by being nasty or late. My employer is just that, an employer. You’re right, it’s not their place to be compassionate for you or for us; it’s their place to make sure the wheels are turning and deadlines are met. You don’t care about the people who are buying or selling their homes, you just care about your own sorry hide. You can cry and whine all you want, the laws requiring AMCs to exist are there for a reason: to protect the borrower. I deal with lousy appraisers all day long who think they’re the absolute best and can do no wrong, and then when they’re late submitting a report because they forgot about it or can’t find comps, I’m the one who has to explain to the brokers exactly why and what’s going on. So don’t sit their on your high horse and moan about AMCs, we’re here to help the borrower because no one else will. Certainly not you.

Hey dude. If you can’t handle the pressure, step aside and let me back in there with a direct lender connection. I never had such problems, because I took the lead position, rather than the subservient one. It’s not my fault, the amc’s are so dang awful at managing the high pressure systems which are constantly present when dealing with brokerage offices. You’ve made many blanket assumptions, which you may think justify your position, but really are more reflective of your lack of licensing, and lack of understanding what sorts of dynamic responsibilities really fall on the appraisers back. You’re just a process clerk, so if you don’t like that, get the appraisal license yourself. If you dare. I’m the one whom meets with the borrower in their own home, carries the personal liability, signs the report with my integrity and license on the line, and answers the tough questions. Tell me your company name. The fee for you guys is going $600+, because of you’re absolutely improper attitude towards appraisers.

LOL there ARE no laws requiring AMCs to exist anymore! Multiple posts and every one demonstrates more than the one before how absolutely uninformed you are about the business you are in! You are nothing more than the paid whores of the mortgage banking industry that facilitates them price fixing and circumventing a variety of federal and state laws…as well as engage in bad banking practices in general.

If you want satisfaction, then sell it on the street because no one is buying it in here!

You sound like a typical AMC. Cold, uncaring and money grubbing with no real empathy or compassion for appraisers.

AMC’s are useless in the appraisal profession. I never invited you to manage my business. I never asked you to deal with my clients on my behalf, to quote or collect my fees. Before you stole my business, I had 2 secretaries, an accountant, an office manager and 8 appraisers. I managed my business successfully for more than a decade before you got crammed down my throat by corrupt politicians. Eappraiseit fraud should have been prosecuted to the full extend of the law. Instead Cuomo rewarded First American Eappraiseit and WAMU’s fraud by giving AMC’s more power with passing of HVCC (now sunset).

AMC’s are a scam and the only reason you have a job is because Cuomo, part owner of an AMC- AMCO, decided to reward the fraudsters and give them even more power.

Keep up the good work. Your true colors are shown by your heartless comments. Keep it up. You are doing a fantastic job of disclosing what you and AMC’s are all about!

Mr. The other side;

I can believe that in your AMC world there are appraisers who are sending in applications, samples, fingerprints, etc. to get on your panel of chumps. What do you think of those appraisers who refuse to work with scum companies such as yours but are still very busy. If an appraiser were so busy that they accepted all they wanted and turned down two $450. assignments each work day would they need your AMC? Let’s see that is $900. each five day work week for 52 weeks should come to about $234,000. if my math is correct. However, it is difficult to take that many assignments while taking four, seven day cruises and several trips to other fun places each year! Of course we do not do that, (LOL) but…….what if we did?

See you in Jamaica next week also in July and August…it sucks to work for AMCs!

To The Other Side:

You management companies are lucky to be here. You are only here because the government made you.

You idiots send an order, then still look for a cheaper faster appraiser. You run LATE because you sat on the deal for 3 days trying to save $10.00 for your company.

You idiots think ordering an appraisal is like ordering a pizza, ya we will be there in 5 days. You idiots have no idea what can go into completing a credible report. You idiots don’t even care. Just tell you clients they will have the report back in 5 days. There’s your trouble making promises YOU can not keep.

Appraisals are HARD. We can sit in front of these computers for 5 long mind bending hours at one shot trying to write a headache deal to the exacting standards made up by someone who probably has NOT appraised in 20 years.

You don’t know we wake up early or work late to get caught up, You don’t care. We don’t know how long each one is going to take, We can kind of guess, but that’s all it is a guess. Until we SEE the house, then we know what we have to do to write a credible report that we are liable for, for what, 7-10 years these days.

You don’t know we work in the pouring down rain to get the job done, you don’t know we work in 3-12+ inches of snow to get the job done. You don’t care we feel a little sick and slow up 50% but just keep typing so you idiots don’t cut us off.

You say appraisers blow your settlements, you cant get a clear to close until everything is done, that’s why you rush us, so the borrower does not have time to talk to another lender. That’s ALL is about with AMC’s. Turn time, Hey look ABC Bank, we get your deals done in 4 .8 days, give us your work, no wonder why they yell at you.

I ran a fantastic business for 15 years until you came into being. Making $350 a job, $450 for FHA back in 2002-2009. I employed people who made us more productive. Faster and better appraisals for the industry. Our fee’s should be $500 – $600 a job. Were do you think all the appraisers went. YOU put them out of business. Now your crying why it takes so long.

My average turn time was and still is 4-7 days. Always will be. Some weeks go good, Some weeks go really bad.

Today I do not have an office manger to assist me, that’s because YOU took our money and do nothing for us! You think you do, but you don’t, You think saving us a couple of phone calls from people looking for the reports saves us time, it doesn’t, because we STILL have to answer Endless status updates for you!

I had a great company doing 30-50 appraisals a week. With NO underwriter letters, Why, cause I TOLD my clients not to bother me, the more they bother us, the longer it takes us to write reports.

I had a great company, Not now with you. You want half of our fee, cause you have a family to feed. Go work at McDonalds and stop being a leach on us sucking our money and doing NOTHING to help us except to keep some crying mortgage brokers off our backs, poor baby.

You don’t have a clue what it takes to write a credible report. You don’t have a clue how long it takes us to get to each property, to inspect, answer the borrowers questions and concerns, You don’t have a clue how measure the house so we can do a sketch properly, You don’t have a clue how long it takes to drive comparables for a photo, You don’t have a clue how long it takes us to get home again, You don’t have a clue how long it takes to download photos, You don’t have a clue how we make revisions to prior reports that we have written in the past 3 months, You don’t have a clue how long it takes to write a report, You don’t have a clue how long it takes to generate an xml file or how long it takes to upload, and reupload and reupload. You don’t have a clue how long it take us to research comps to get the right 5-9 so we can take the photos while in the subjects neighborhood. You don’t have a clue how long it takes to keep our computers up to date, You don’t have a clue how long it takes us to order supplies for our offices and fix our tech issues that pop up once a week, You don’t have a clue how the MLS’s keeps changing and we have to learn their NEW system, You don’t have a clue how we give up our lives living with you idiots trying to get the cheapest fastest appraiser. And YOU pay the price for that. Your fault !

I worked for 1 company, 1st report graded 100%. 2nd report with no revision requests grade 30%, Why, didn’t know, than thought about it, I would have went right to the top of the computer ordering system, but with higher fee’s than most, 3rd report graded 100%. all they did was LOWER MY “score” so the computer didn’t send orders over at my slightly higher than typical fee. When I called the big guy to see why I was graded 30%, no return call, Called twice more, NO return call, Done with them. Again, I did the jobs no one wanted, Wrote perfect reports and no return call.

An appraiser friend of mine was cancelled on 10 minutes before getting to the house. O.K., it happens, but a week later, 10 stips were sent to her, she politely replied please send it to the appraiser you gave the deal away too, a week later, same thing 10 more stips, apparently he/she didn’t do 3 of them right the 1st time, than a week later another 7 stips, this time she replied, “Its a shame you canceled on me, your report would have been written within 48 hours, with no stips. 3 week delay to the borrower so the AMC could save $10-$20.

Got what they paid for.

You Sir, simply do not have a clue.

Because you never sat with an appraiser for a week.

Know this Sir, You are despised by US !

Nice comment Chris but let’s be honest; after 7 years appraisers still don’t despise AMCs enough to FIGHT BACK. I hated AMCs for years after choosing to “walk away” from the BS. Over the long run however I came to despise appraisers far far far more because they were too lazy and too stupid to organize and fight back.

If you’re going to hate someone Chris, make sure that you’re hating the right group. It took me years to figure it out but your real enemies sleep all around within your own camp.

I find the amc disgruntled employees comments to be refreshing and affirm my personal positions. I always knew that amc upper management laid the stage so to speak, typcasting and stereotyping appraisers as disposable heroes. I had no idea just how bad that was though. What a brilliant strategy; Purposefully attract the weakest appraiser participants with unreasonable engagement terms, and line them all up to get brow beaten and fail, by way of proving to your amc employees they really do have bad attitudes and provide poor service. Just one piece of the puzzle is missing for this amc employee to be enlightened; The amc orders are prioritized last. Back of the bus, no future value. It’s not my fault they chose an antagonistic position against appraisers, rather than a symbiotic one. It is enlightening to hear what sorts of typecasting and stereotypes they put forth about appraisers though. If the amc would roll out 550 flat rates, they’d see a tremendous increase in appraisers service. But that would of course, put the income back where it belongs. As soon as a telecom office clerk has anything to contribute to my operational efficiency, I’ll be sure to let them know. Has not happened yet though, and it’s been dang near a decade already. I think amc’s misunderstood the term; appraisAL management company. They mistook that for appraisER management. For the record, HVCC and the proliferation of amc’s was set in place to stop corrupted lender practices, not corrupted appraiser practices. And lookie here, the amc’s are acting as the long arms of the lenders biased interests, and have done nothing to inhibit undue and unethical lender pressure. I often quip back to appraisal management companies, that I find it remarkable they have not yet achieved any reasonable leverage to actually manage anything. I’ve never seen such a large group of ‘managers’, whom are powerless to effect any business decisions without approval from someone else. Remarkable, truly remarkable.