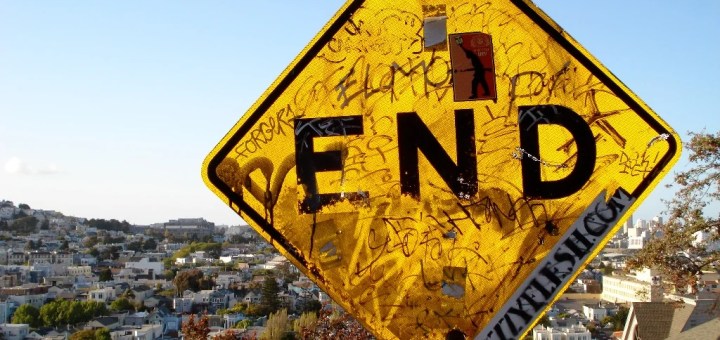

Proposal to End Appraisal Requirement

Regulators’ Proposal to End Appraisal Requirement on Some Home Sales of $400,000 and Below…

Regulators’ Proposal to End Appraisal Requirement on Some Home Sales of $400,000 and Below…

The Federal Deposit Insurance Corp., the Office of the Comptroller of the Currency, and the Board of Governors of the Federal Reserve released a proposal that would increase the appraisal requirement from $250,000 to $400,000, meaning that certain home sales of $400,000 and below would no longer require an appraisal.

According to data provided by the FDIC, the agencies estimate that increasing the appraisal threshold from $250,000 to $400,000 would have exempted an additional 214,000 residential mortgages at regulated institutions from the agencies’ appraisal requirement in 2017, which represents 3% of total HMDA originations.

The regulators say the move is in response to “concerns raised about the time and cost associated with completing residential real estate transactions.”

Under the proposal, instead of requiring a full appraisal, lenders would need to obtain an “evaluation consistent with safe and sound banking practices.”

To read the full proposal from the FDIC, OCC, and Federal Reserve, click here.

- Reconsider the Rule on Deferred Appraisals - May 11, 2020

- Appraisers Considered an Essential Business - March 22, 2020

- Bringing Evaluations Under USPAP’s Umbrella - September 6, 2019

Bye bye career.

Bye bye housing market. I can hear it now, but we have sales over a quarter million, that has to make our worth $200,000…

This is so dumb, I bet the borrower won’t see any savings, the savings will go in the pockets of the banks. Apparently all to save a few days on turn time and a couple hundred dollars on a note that is 5 figures or more is incredibly short sighted which is par for the course. The banks will get a pass and this will turn into another financial fiasco

Ross Grannan yup. More winning !!!!!

A solid track record of winning for big lenders since 12/23/1913. A day that will live in infamy. The creature from Jekyll Island lives on, and on, and on, and on. If anyone were to point the finger at any single individual, it would be a rather clear reflection of quite poor understanding of the over all problem, and what led us to where we are today.

This is wrong

Because the cost of the appraisal stops borrowers from buying homes because it’s so prohibitive ridiculous

ridiculous

Ridiculous

Barry M. Taylor

Jeremiah David Taylor?

In 9 years AMC’s drove the profession into the ground screaming about an appraiser shortage when they spent 2-3 weeks shopping for a $250 2 day turn time schmuck, then told the lenders we can’t find an appraiser and blamed their idiotic delay on us!

This has come up before and is the stupidest thing yet. Anything to squash the appraisal industry.

Well, the only good that could come of appraiser’s becoming obsolete is that MOST ALL OF THE SCUMBAG, BACK RIDING, SPINELESS, THIEVING, BUTT HOLE AMCS WILL SOON FOLLOW! They can then move on to bottom feed off of other professions (attorneys, real estate agents, title companies etc) all of whom sat by and watched us get swallowed up by these AMC assholes that thought it was better to make money off of someone else’s hard work than to actually make their own living.

I think the AMCs are ready to go with their alternative evaluation product, they are partly behind this, they data mine as much as anybody

Sadly I believe this is true.

What could possibly go wrong with this brilliant idea?

Let’s do away with home inspections, too. $300-400 isn’t worth the money to keep you from buying a mold infested, radon filled piece of crap that sits on an obvious sink-hole, right?. Same with appraisals. A few hundred dollars is WAY too much trouble to keep a buyer safe from getting ripped off on their largest investment. Who cares if they end up underwater and owe way more than it’s worth. Hey…why even do a mortgage? Just hand everyone the keys and say pay me whatever, whenever you can. Applying for a mortgage takes too long and there is a shortage of qualified lenders, too, right? Just show me da money and hand me da keys. Boom. Done. *going to make popcorn and watch the real estate market implode yet again. Getting my 2008 calendar out.*

Until the foreclosures start then it’s toooooo late.

Nope, I’m looking forward to the day. REO is my favorite work type. I’m already ramping up for this right now and getting out the old dusty reo key ring, the on the go backpack, and have been marketing and picked up a few directs specifically for reo. ive it a year or two, it’s been scheduled to happen regardless of who is or is not in office, which way anyone votes, etc. Soon.

There’s always a cycle. I agree it’s coming, knowing when is the issue

We’re headed for a MASSIVE housing crash… a la Great Depression.

The $400K threshold is already legal for a major portion of the US with the passage of S.2155 or the “Economic Growth, Regulatory Relief and Consumer Protection Act” this summer. It took the breaks off the banking industry, some of which were in place since the Great Depression in order to protect consumers. Now they’re getting rid of appraisers altogether. Why? Because we’re the last gate keeper preventing over inflation and slowing lending. In other words, we’re last “ethics check” on the line to prevent “lending gone wild.” Remove appraisers, the public is vulnerable.

What really bugs me is that when the dust settles after the next economic H-Bomb that’s about to occur, they’ll still probably blame the appraiser.

https://www.americanprogress.org/issues/economy/reports/2018/02/28/447264/fact-sheet-senates-bipartisan-dodd-frank-rollback-bill/

Dawn Aubrey yup. Blame the appraiser even when there wasn’t one

The article is a great read. One problem, it’s written in a bubble, no mention of Glass-Steagal. It’s tough to sell and profit from the concept of power to the people, complete individual property rights, and a debt free approach to personal and governmental finances. Let them fail. Let the lenders and all the foolish consumers of the world who dealt with them, lose their hats, their shirts, and their land. Perhaps they’ll have a slightly longer memory retention regarding the dangers of debt this time around…

@Baggins, oh… if the cookies would only crumble that way. The bullet points of the article, and between the lines, hint that the next crash will be monumental, increasing the number of banks that are “Too Big To Fail.” That means the US Taxpayer will be the one to foot the bill. I personally think when the next crash comes, it will resonate like the Great Depression.

When this bill passed, I freaked out and started researching and reading, to protect my business and my personal finances. If you want a fabulous read on the topic, check out https://www.amazon.com/Coming-Financial-Crisis-Wizards-Curtain-ebook/dp/B019OXUO8Q/

The Peter Schiff’s of the world will always be there. So will gold and silver. Patriot Trading Group 2017; Did you know that lenders changed depository rules. Now your deposit is recognized as a credit to the bank and you are the creditor.

Already some banks internationally have dabbled with austerity and have requisitioned credited deposits to offset illiquidity. Adventures of the guy who just started paying attention; “if the whole world is in debt, to whom are we indebted?”. Don’t be too concerned with bail ins and bail outs, that’s just clever new language for hundreds of year old typical lender behavior. Besides, we’ve been paying for it for a very long time, since 12/23/1913, if you had to attach a semi recent number to our current economic structure. Cheers

@Baggins, yes, I knew that about deposits. I learned that from reading The book I linked, and others by the same author. That’s why I’m concerned that it will be taxpayers footing the bill the book I linked is pretty well researched and talks about why this stuff occurs, who plans it and who profits.

the book I linked is pretty well researched and talks about why this stuff occurs, who plans it and who profits.

What I dislike is spending YEARS to become an appraiser only to be made semi-obsolete. For lack of a better phrase: that blows. Certainly, appraisers won’t go away over night but it may be difficult to be viable. For now, I’m delivering what I consider to be excellent service to my clients who truly want a good appraisal, one backed by solid evidence, well researched and defendable. Those clients are still out there, Thankfully.

The best thing one can do in this environment is to flourish and prosper despite it all.

I don’t think it’s to save time or cost ….. I think it is to manipulate to get the values to make all deals work . Period!

Lenders have a long history of not liking checks and balances systems. At one point several hundred years ago, a few million farmers traveled on boats across the oceans to hostile territory just to escape their influence. The lending rate may be at historical lows, but usury remains and is more institutionalized than ever before. What’s new?

If this goes through my business model no longer works

I think we have all seen this coming, but the move to destroy the protections for consumers got even worse since trump and his band of gypsies occupied the white house and cabinet. The environment will suffer untold damage with their short-term policies, and lots of leases for drilling, pipelines and new refineries for oil will be their priority, and when they are rid of appraisers, they will have another free-for-all with seedy lenders and scumbags selling the country out for their short-term profit.

This is a proposal; they are asking for comments from anyone, so I suggest we get our pencils out and sharpen them and write and submit a warning about the dangers of a rule that excludes a check and balance against those who are profiting on a commission basis which are realtors. The really funny thing is my local board of realtors is requiring me to take an ethics course every two years to continue my membership. So far this year, my appraisal business has evolved to a cost center and there is no more profit, so my business is dead.

This is the carrot for all those yahoos who voted for trump and his band of thieves. Then they can remodel and upgrade their crap shack in the rural or urban areas so they will be in better condition when the crash takes them away from the idiots who are buying them now. The likely outcome will be that since they don’t have to have real property to have an appraisal, opportunity zones in poor neighborhoods will give tax exemptions for new projects in infrastructure; therefore, private industry can build the new bridges and get loans and not have to fuss with any taxes for improving the area. When the working people can’t afford any type of housing the numbers of people on the street homeless will grow exponentially because they will also own the rental properties, get loans to fix them, then increase the rent, and get a free pass without having to pay taxes. Never mind that they will be begging the American people for another bailout, and the answer will be to cut our medicare and social security which they raided and after working all your life and paying into that, you may have to just do without those ENTITLEMENTS. That will definitely cut people’s lives short without their benefits, but they act like we are all lazy and should just be greedy like them and lie and cheat. Most appraisers have ethics that are superior to realtors and attorneys, so I guess the American dream of a job, house, education, health and retirement will become a thing of the past for most citizens.

The point I am making is that many of us are depending on the leaders of our profession to protect us from ruin, but clearly they have helped sell us down the river of no return. We were too busy to write letters, get involved, and now we will be too depressed to write a letter to the Feds and comment on the proposed rule to get rid of the appraisers, so I hope people wake up and stop watching fox news (trump tv) and get out and vote for some honest politicians. We used to not have to talk about politics as appraisers, and we are very independent people, but we have dropped the ball and watched as our incomes went down and since AMCs are owned by mostly banks, they don’t care if they go out of business, then they can still get all the fees without the fuss of dealing with an ethical appraiser. It will be dog eat dog, like in third world countries because we are selling out to the crooked fat cats, and there will eventually be another civil war with the have nots trying to get some of their scraps.

You’re such an idiot, another case of Trump derangement syndrome. It’s all the fault of one person, recently elected to office. Citations please. Fake news does strange things to the mind, and you’re the next willing victim. Put the blame where blame is due, blame the FED.

Pop quiz for you. Who is the current president to float the taboo proposition we should end or dramatically restructure the FED, and how has the corporate controlled media apparatus worked to discredit him. (you should know this one!) image attached.

God Bless America

I met a gentleman that told me he was an activist for 35 years, I then asked him if he was ever able to accomplish anything, he replied no.

Josh DeSouza, ‘Death of a Nation.’ 2018

What a great movie.

I don’t understand. It says increase from 250 to 400. I do appraisals on homes below 250 all the time. They haven’t been exempt.

it’s only for non Fannie non fha loans

That’s what I figured. The 250 threshold hasn’t affected me, so I’m guessing the 400 won’t either. Thanks for your response!

Also Andy, lenders make internal decisions regarding risk assurety, and that ties into how they package and sell loans in portfolios, manage underwriting and loan package assimilation, access capital funds through fractional reserve lending approaches, the total lending package, etc.

If you want that full fee, you’ve got to be willing and able to seek out direct lender panels whom do not use amc’s, and also often be willing to work with lenders who’ve had their hand slapped for aggressive practices by the doj, among other entities.

Nothing says we’d better return to full appraisal service like a hundreds of millions potential liability for inadequate loan surety practices from the doj. Remember, these things happen in the arrears and we have not even seen the eval program ramp up to full speed, or hit the wall yet. They’ll look at it, eventually. Except this time around, amc’s will be involved with deep pockets and they’ll be the obvious first target of upset portfolio managers and their doj henchmen. Be careful out there, quality appraisal service has nothing to do with saving time, or saving money, or the essentially arbitrary deminimus lending figure. Demins are a figure taken from thin air that mean nothing essentially. If lenders were not fractional reserve lending, there would be no demin figure and you’d have to beg on bended knee to borrow a single dollar.

$400k demins? Yes, because only wealthy deserve essential checks and balances systems… Do you ever get the feeling all this regulation is to protect the monopoly structure of lenders and is no longer intended to protect American consumers?

Major bank settles FHA mortgage case with Justice – Banking Exchange

That’s a little beyond me. Obviously you know more about how it all works behind the scenes than me. All I know is I do quality appraisals that keep me out of trouble. Scope creep is a problem and the different rules of different AMCs is annoying. But I actually like AMCs. You get one AMC client and 5 lender clients come with it. As far as getting the full fee, I get a minimum $350, and a lot of the time higher than that. I do not believe that if AMCs went away that the lender would continue to pay the same amount for appraisals and pass the extra $ on to us. They would say, hey this is great, now we only have to pay $350 instead of $525. Like I said, a lot of my fees are above $350, but even at $350 I can do 1.5 appraisals per day, and if they’re close by, 2 per day, which is well into the 6 figures per year. I don’t understand the anomosity towards AMCs, unless you think they’re working to put us out of business, which I haven’t seen. I am of the opinion that things are good now, and the FED shouldn’t try to fix what isn’t broke. If they did go to AVMs, I don’t think it would work out well, and the system would eventually come back to appraisers, but in the mean time it would suck for us. I know most of my work is complex, and the idea that a computer could do it is not feasible. But as it is now, I’m not concerned that AMCs get a cut of the fee the borrower pays. I’ve heard appraisers predicting doom for us since I started in 2002. I remember in 2013, many posters said it was over. And what followed? Years of plenty for appraisers. I think getting rid of AMCs and going back to the days when loan officers called you asking for an extra 10-15k on your value would be enough for me to get out of this industry. I hated those days. So no direct lenders for me, I’ll stick to AMCs. But each to their own.

I’ve put a few messages out for blog response assistance, because I can’t help you.

Andy, I was getting $350 20 years ago

Andy, Appraisers assume most of the liability and get paid less and less over the last 20 years. With my Finance Degrees time value of money we should all be getting paid over $500 per appraisal.

That would be great, I’m all for it.

In house non secondary market residential loans only it won’t affect much since lenders have to have qualified individuals on staff to perform evaluations that meet FDIC guidelines safe and sound practices and they can’t use SEV BPOs or AMVs alone. Who is going to do those internal evaluations and with what data?

One of my bank clients hired someone out of college at 30k per year to do all of their in house loans under 250k. No training at all. They just take a picture of the property from the street and plug the tax record data into an avm. That is what they are using as a qualified individual.

If they are lending their own money, they can do what they want.

is this what they are currently doing?? Wow

Good one Dan. Funny how the tone and messages change when a new revenue source is established…

The Truth About AVM Compliance with Interagency Guidelines – April 19, 2011

An eval is not always reliable because… Strike that. Just go with it, evals are edgy and trendy now.To answer your question; Corelogic, obviously.

Penny wise, pound foolish revisited.

Let’s do away with Title Costs, transfer fees and cut Realtor fees. Let’s just not have a closing to expedit the process shall we? 2008 here we come.