Low Rates and Plentiful Appraisal Waivers

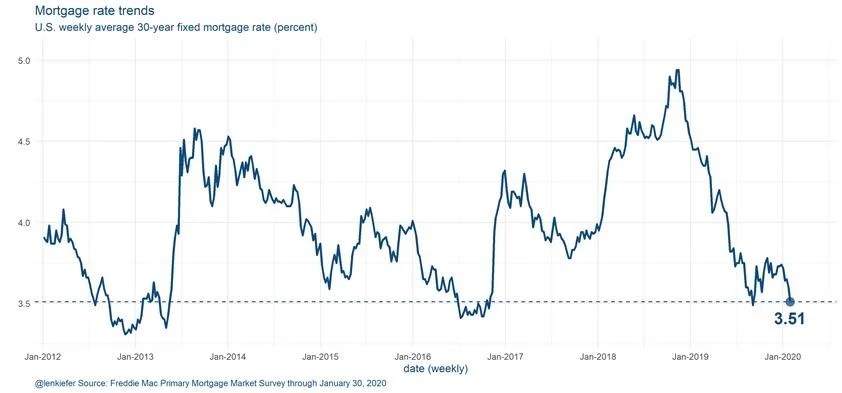

The graph below comes from Len Kiefer, the data guru at Freddie Mac. Are we due for even lower rates? Who knows. But they have been lower not long ago.

The graph below comes from Len Kiefer, the data guru at Freddie Mac. Are we due for even lower rates? Who knows. But they have been lower not long ago.

Theoretically, appraisers should have been really busy since about November 2018 through this past year. Were you? Me, not so much, but I don’t work for many AMC’s either.

The fact that the GSEs and others have diminished the value of getting an appraisal done has adversely impacted our work. Waivers are plentiful now, and the raising of the de minimus threshold to $400K for non-GSE loans has reduced the number of necessary appraisals.

I’ve often said everything in life is cyclic. There are life cycles. Mortgage rates are no different.

Will be interesting to see if current rates go lower, and when the upturn will happen.

- App-solutely Clueless: When Sales Tries to School Appraisers - October 17, 2025

- New UAD Overhaul: What Appraisers Can Expect in 2025 & Beyond - September 19, 2024

- Cindy Chance Terminated - September 16, 2024

Not busy as I should be. One of my clients stated they get waivers on 50% of their deals!

My Credit Union orders have gone down too. Rural D gone, I will not sign up with those AMC’s. Keeping in contact with local attorneys asking them to keep me in mind when this all blows up. My mentor did work for a few of them while I was training at the begining of the last fiasco.

You can thank the GSEs and there data theft program that was created on the backs of working appraisers.

Pretty difficult to stay motivated when every Federally Related appraisal report we complete contributes to our own demise. It’s like being punished for doing a good job.

Mortgage Brokers and Loan Officers who re churn deals that are made “eligible” by previous low Collateral Underwriter scores might the most THANKLESS P.O.S. financial professionals on the face of the earth. They take all the credit and get all the compensation while the appraiser gets absolutely NOTHING.

Hoping waivers eventually put all the AMCs out of business.

In lieu of ordering new appraisals, Credit Unions are ordering 1004Ds and/or appraisal reviews with other appraisers on older dated appraisal reports just completed by the original appraiser. Dont see any benefit working for Credit Unions.

I am amazed that it is taking so long for the banking lobby to finish appraisers off. Maybe they’re simply having too much fun playing Whack-A-Mole to break out their nukes.

You’re right retired, it’s like having a pimple on your ass after both your arms have been ripped off!

I have not been as busy as I used to be, I would be booking 1-2 weeks out. Now I have 3-5 a week if I’m lucky

Mortgage Application Volume is presently at a 13 year high nationwide…

Check this out

https://www.npr.org/sections/health-shots/2020/02/12/804943655/doctors-push-back-as-congress-takes-aim-at-surprise-medical-bills

Doctors want a say in what they get paid for the work they do. Wow so we’re not the only ones under attack.