Consumer Involvement with Property Value

“Help” the consumer determine a value

Appraisers,

There is a little known provision in the new TRID mortgage loan application process that may become a future issue for appraisers, especially when the loan is for a Refinance.

This is what the Loan Estimate, provided by the lender, requires the CONSUMER to do:

You (the lender) must provide a Loan Estimate to the consumer, either by delivering by hand or placing in the mail, no later than three business days of the receipt of an application. An application is considered received when the consumer provides the following information:

- Consumer’s name,

- Consumer’s income,

- Consumer’s Social Security number to obtain a credit report,

- Address of the property,

- Estimate of the value of the property, and

- The mortgage loan amount sought.

While this may seem innocuous, it could, in time, bite appraisers in the behind.

Why? Because CONSUMERS have been known to take exception to appraised values. Especially when the consumer has an overly extended, emotionally tied, ‘number’ fixated in their noggin.

These kinds of consumers have been known to file formal state regulator complaints against appraisers, claiming improper value. Taken to the extreme, lawsuits have been filed alleging misconduct or misfeasance on the part of the appraiser.

Back in the old days, pre-TRID Oct 2015, the loan officers would try to determine a ‘number’ to shoot for, for the refinance loan. But this was informal, and not ‘required’ as the present application mandates.

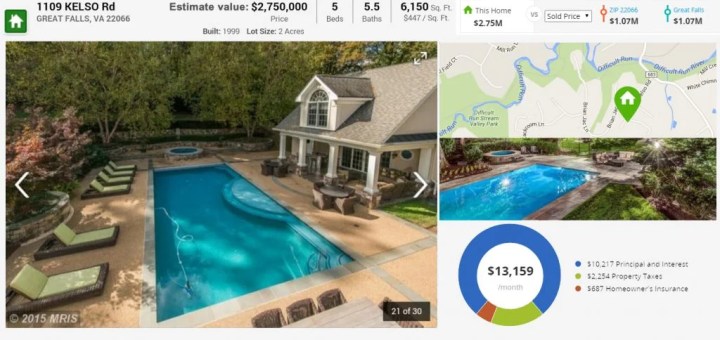

The other hidden aspect of this Loan Estimate regulation is the potential for the loan officers to “help” the consumer determine a value. We appraisers won’t know if that assistance has been given, and it likely won’t be something the loan officer will reveal in their file. But with all the on-line valuation services available, it’s not inconceivable that this will happen.

We won’t, or shouldn’t, be given this ‘presumed value’ at the time of assignment. But, again, if it’s way out of line, we appraisers may get challenged.

There is nothing “we” can do about this Loan Estimate situation.

What we can do is be extremely careful when establishing our Opinion of Value for properties. Make sure you do proper due diligence and research to validate your decision. Document everything. Keep a proper and complete workfile.

Let’s be careful out there!

- App-solutely Clueless: When Sales Tries to School Appraisers - October 17, 2025

- New UAD Overhaul: What Appraisers Can Expect in 2025 & Beyond - September 19, 2024

- Cindy Chance Terminated - September 16, 2024

I think the link might be bad.

There is no article on this link

Sorry folks, a scheduled update early this morning broke some parts of our website. It’s been revolved now and you should be able to view the content of the articles.

WHAT ELSE IS NEW! Let me the consumer check that Zillow (etc) crap and really see what my property is worth!

I’m going borrow a little something from Bubba Jay with a twist,

….the piling on continues…

If the borrower doesn’t like the appraised value, they gripe and do whatever they will do. The appraisal should always be air tight regardless

Well, with all the “data” the banks have on a property and their AVM’s they should be able to get a decent ballpark from which to calculate an appropriate appraisal fee, however not sure how it will work out in reality.

trid is now the name of that loan officer that forced many feeble minded, lack of value control, skippies to come back from the grave. this is too funny. never changes.

Double blind pressure to hit an invisible number. What’s wrong with knowing about the lending expectation ahead of time, so the appraiser can properly comment on why that expectation was or was not met, in the appraisers unbiased analysis? This industry has lost track of the meaning of checks and balances systems. Again,….. What’s new?