Read That Agreement Before You Sign or Leap

Having the most unfair agreement will cause the lender or AMC to lose those appraisers

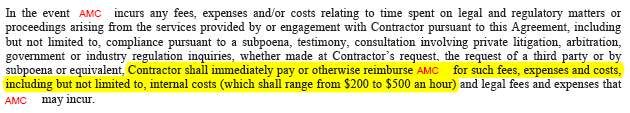

I recently ran across the provision below in a new contractor agreement between an AMC and its panel appraisers, when one of LIA’s insured appraisers asked me to take a look at the agreement. The contract contained the average indemnification provision found in most unfair AMC contracts in which an appraiser promises to defend and reimburse the AMC for “any and all liabilities, damages, costs and expenses (including all legal fees) arising out of or relating to any claim, action, suit, complaint, liability, damage, or other proceeding” relating to appraisals done by the appraiser and a long list of other things.

But then the contract got a little more crazy:

Under this provision, the appraiser is promising to immediately pay the AMC for the AMC’s own internal costs, as well as its actual out-of-pocket costs, for responding to any legal or regulatory inquiry relating to the appraiser’s services or appraisals — at rates ranging from $200 to $500 per hour. So, to use a couple examples, if an unhappy borrower who is disappointed with the appraiser’s opinion of value complains to a state board about the AMC or if the CFPB makes a regulatory inquiry to the AMC involving an appraisal, the appraiser could then be demanded by the AMC to pay the AMC’s internal costs for responding to that matter (at $200 to $500 per hour) and also the AMC’s actual out-of-pocket expenses.

As a lawyer, I draft agreements like this myself. When lenders or AMCs ask me to help them with indemnification issues in their contracts, I have a frank discussion with them. I tell them, that, yes, as a clever lawyer, I could draft some very one-sided language that might sound ultra-protective and advantageous to them, and I tell them that, yes, a lot of appraisers or other contractors would actually sign a contract containing those unfair provisions. They’d sign the contract either because they don’t read the agreement, because they don’t care and have nothing to lose, or because they just need the work. But then, I have to tell them that they probably don’t want to go that route and should stick with something that is actually somewhat fair. The reason for this is threefold: (1) the lender or AMC should want to have access to a panel of appraisers who read agreements, care about what they sign, and have other options for securing appraisal work — such appraisers tend to be more stable in their careers and tend to produce higher quality appraisals; (2) having the most unfair agreement will cause the lender or AMC to lose those appraisers; and (3) in the real world of appraiser-liability litigation, very one-sided indemnification provisions have not proven to be of value to either lenders or AMCs. And, then there’s another reason: some versions of unfair indemnification provisions seen in AMC agreements violate a few states’ AMC laws.

In the context of lender-AMC-appraiser agreements, it’s not just appraisers who blindly accept liability. Indeed, in many of the service agreements that I see between lenders and AMCs, AMCs themselves readily acquiesce to the shifting of massive potential liabilities from the lender to the AMC. Many AMCs, especially those closer to the edge of insolvency, will accept any and all such provisions to win a lender’s business. If lenders think that this is offering them security, they too are wrong. And, from a risk point of view, the lender is better off focusing on the development of a viable relationship with the AMC or appraisal firm that will result in higher quality appraisal work and overall less risk. Contractual promises by the AMC to indemnify the lender for every imaginable financial loss or liability really don’t mean anything in bankruptcy court.

- LoanDepot Appraisal Discrimination Settlement - March 28, 2024

- Should Property Data Collectors Be Licensed? - February 29, 2024

- VA Appraisal Request Form at Heart of AIR Violation Class Action - May 23, 2023

OR if you really want to be a success in life SWITCH careers completely before you sign & leap.

Face it folks; residential appraising is the “profession” of losers!

Who would sign this? I want to know which AMC this is.

“As a lawyer, I draft agreements like this myself…”

Then you turn around and advise the appraisers who would be governed by this agreement that “they should stick with something that is actually somewhat fair.”

Later, it seems that you would even advise the AMC or the lender that they “should want to have access to a panel of appraisers who read agreements, care about what they sign…,” etc. In other words, that they should look askance at someone who actually signs one of your agreements.

I am evaluating an agreement with a similar indemnification clause for another type of contractor relationship. I must say, given what I read here, that I would be inclined to look for a different lawyer. I don’t consider it a benefit to have an attorney who would write a contract known to be unfair, a false flag (“If you sign this contract, you’re an idiot, and we won’t hire you”), and in violation of [some] state’s laws.